Wagely is an Indonesian fintech company that has made a name for itself with payroll access: a way for workers in the Southeast Asian country to get an advance on their salary without having to resort to high-interest loans. With 500,000 people now using the platform, the startup has expanded into a broader “financial wellness” platform and has now raised $23 million to further its efforts.

The news is particularly noteworthy given the financing crisis faced by Indonesian startups over the past few years, highlighting how developing countries have been hit harder than developed markets in the current tech bear market. The Indonesian Financial Services Authority said in January that financing for new Indonesian companies fell 87% in 2023 from the previous year, from US$3.3 billion to US$400 million.

This kind of financial pressure isn’t unique to startups: the average person is under greater pressure.

Although consumption of goods and services has grown significantly, wage growth in various industries has not kept pace. Workers are looking for solutions, including credit, to meet their needs between fixed pay cycles.

But access to credit isn’t everywhere.

Millions of workers are underbanked and lack credit histories. In some cases, these workers are forced to look for alternatives, which may be finding a job that pays them in shorter intervals than the traditional one-month pay cycle. This results in higher turnover rates for employers. Likewise, workers who are unable to borrow money from banks or financial institutions during emergencies are often trapped by loan sharks who charge exorbitant interest rates and engage in predatory practices. It’s no surprise that global banking institutions like JPMorgan Chase see earning wages as a financial panacea: it’s important to both employees and employers.

The concept of earning a salary is common among companies in developed markets such as the United States and the United Kingdom, especially after the COVID-19 pandemic impacted many people’s jobs and household incomes. In 2022, Walmart acquired payroll access provider Even to offer its employees the opportunity to be paid early. Other major U.S. companies, including Amazon, McDonald’s and Uber, also offer plans for employees to receive their pay early.

Jakarta-based Wagely introduced this model to Indonesia in 2020 and entered Bangladesh in 2021. The startup believes that providing wage income in these markets is even crucial, since 75% of Asian workers live paycheck to paycheck and are paid significantly less than they are paid. counterparts in developed countries such as the United States.

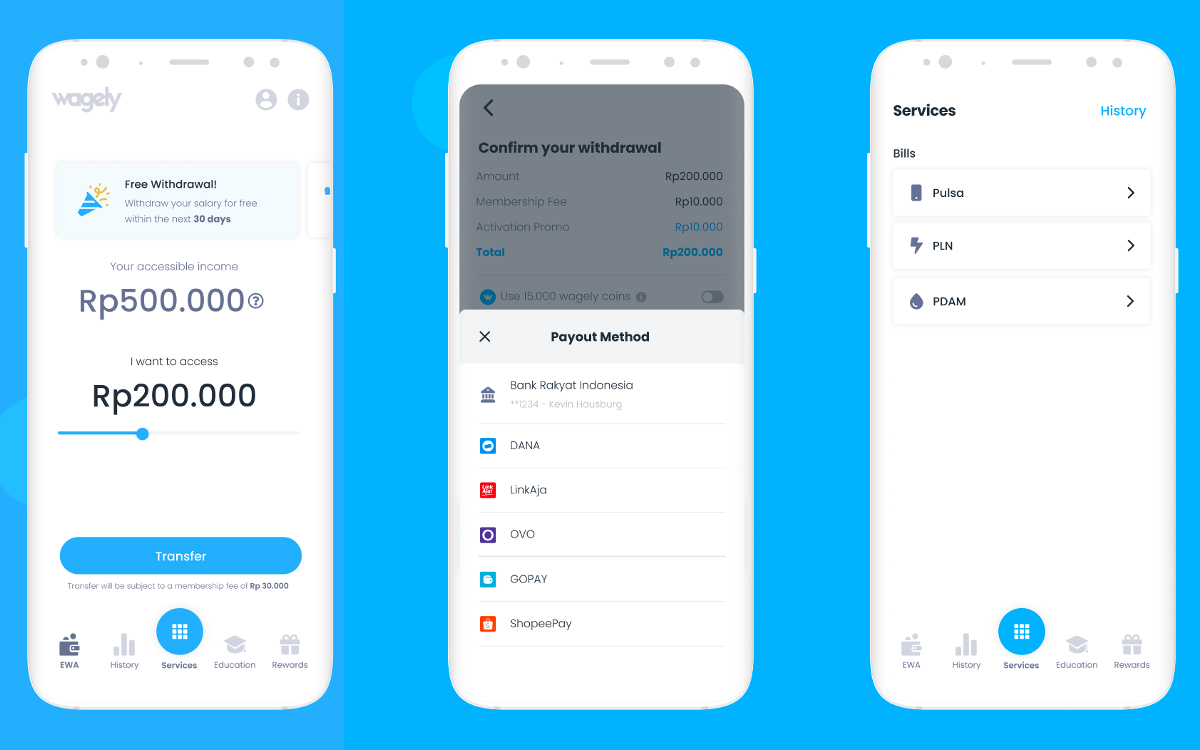

Image Source: Wagli

“We’re working with companies to give employees a way to access their paycheck any day of the month,” Wagely co-founder and CEO Kevin Hausburg said in an interview.

Like other payroll access providers, Wagely charges a nominal flat membership fee to employees who receive their payroll early.

Hausburg told TechCrunch that the fee, which he described as a “payroll ATM fee,” typically stays between $1 and $2.50, depending on the portion of an employee’s salary they withdraw and their location and financial situation.

Wagely has about 100 employees, about 60 of whom are in Indonesia and the remaining 40 in Bangladesh. In 2023 alone, it paid more than $25 million in wages through nearly 1 million transactions and served 500,000 employees. .

The startup’s revenue has grown about five times since the last round of funding was announced in March 2022, with business volume tripling last year, the founder said, without disclosing specifics. These revenues come solely from membership fees that startups charge their employees. Still, it’s burning cash.

“We’re burning cash because this is a scale game,” Hausberg said. “However, the margins and the business model itself are sustainable at scale.”

While Wagely has been an early wage earner provider in Southeast Asia, there are a few new players in the region. This means that new startups face some competition. In addition, over time, some multinational companies may also compete with Wagely by entering Indonesia and Bangladesh.

However, Hausberg said convenience makes the startup a unique player. According to the founder, it only takes three clicks from downloading Wagely’s app or visiting its website through a browser to depositing money into your bank account.

“This is unmatched by other competitors because other wage capture companies focus on different things,” he said.

One area where global wage access providers have shifted their focus today is lending – and in some cases, borrowing money from employers. Some platforms also include advertising to generate revenue by cross-selling different products to employees. However, Hausberg said the startup won’t offer advertising or any other services that don’t make sense to the workers it serves.

“Focus on what your customers want. Don’t get distracted and don’t try to optimize short-term revenue,” he points out.

Wagely’s business model is based on economies of scale. That is, to achieve profitability, it needs to scale from half a million people to millions.

In its latest funding round led by Capria Ventures, the startup plans to use the funds to delve deeper into Indonesia and Bangladesh, expand into financial services such as savings and insurance, and explore use cases based on generative artificial intelligence, including automated document processing and local language conversational staff interface.

Recently, Wagely partnered with Bangladesh Commercial Bank Mutual Trust Bank and Visa to launch prepaid salary cards for employees in the country, which has a smartphone penetration rate of about 40% but has a huge card payment and ATM infrastructure. The founder said the company is eyeing other Asian countries but won’t be entering any new markets immediately.

Wagely did not disclose the amount of debt versus equity in the round, but confirmed it was a mix of the two. The portion of the debt will be earmarked for payroll. It’s also the first time the startup has raised debt, having taken a total of about $15 million in equity prior to this round.

“Growing the business on equity alone is not sustainable, especially because we pay our workers upfront, and the only way to grow this business sustainably is to have a very strong partner on the debt side to provide you with capital. Now It’s just the right time,” Hausberg told TechCrunch.

Employers do not advance wages themselves; instead, they reimburse Wagely for the amount paid to employees at the end of the payroll period. This requires startups to maintain sufficient reserves to cover salary advances to employees who sign up on the platform. The startup conducts “rigorous checks” on employer partners and works with publicly traded, compliant and reputable private companies to reduce the risk of employers not repaying salary advances provided to employees at the end of the payroll cycle.

Dave Richards, managing partner at Capria Ventures, said in a prepared statement: “The Wagely team has demonstrated exceptional execution in delivering sustainable, win-win financial solutions to underserved blue-collar workers and employers. Impressive growth.”

from Tech Empire Solutions https://techempiresolutions.com/indonesian-fintech-company-wagely-creates-banking-while-helping-the-unbanked/

via https://techempiresolutions.com/

No comments:

Post a Comment